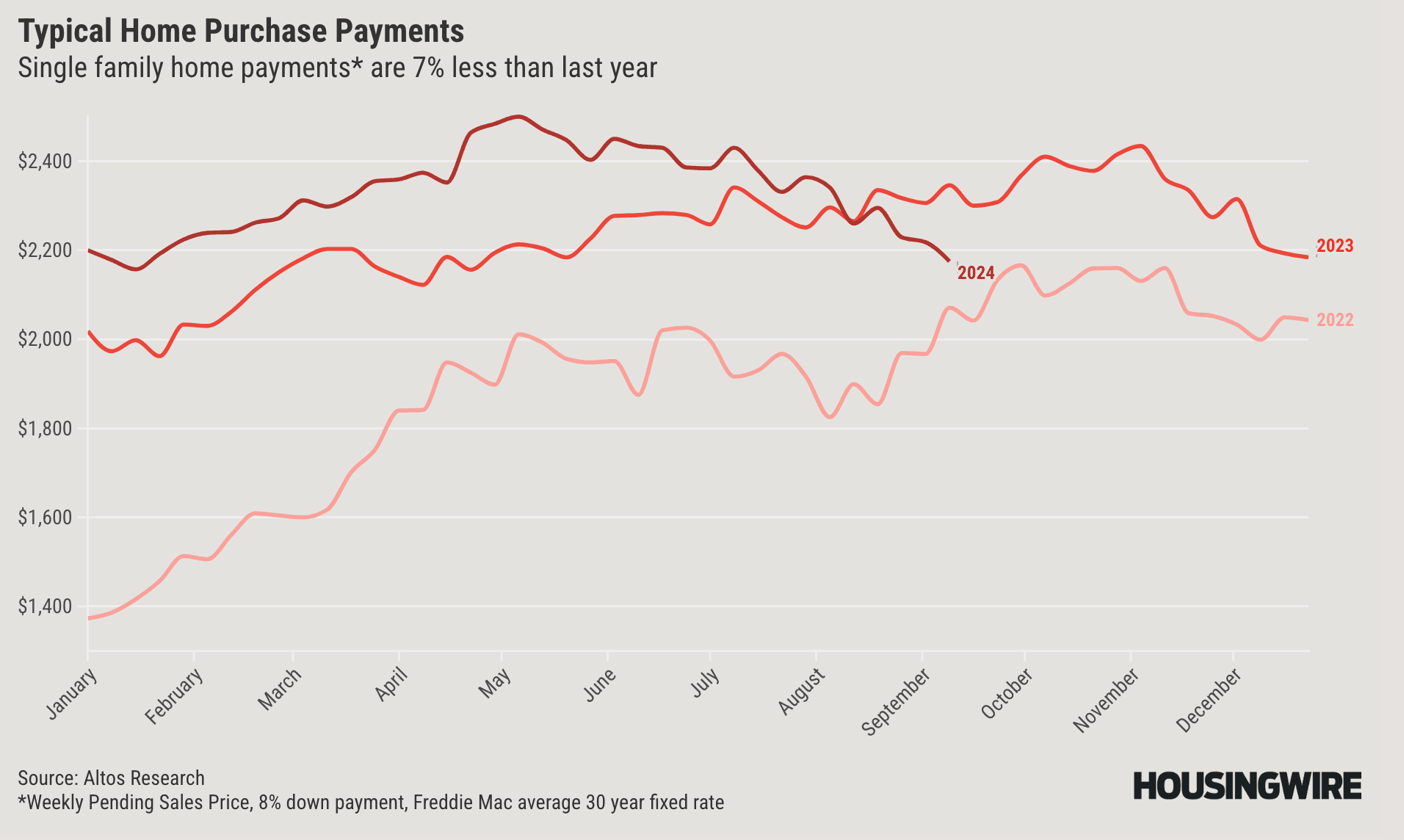

If you were fortunate enough to buy the typical U.S. home in June 2022, you probably locked in about $1,400 a month in mortgage payments. Due largely to higher mortgage rates, that same home today would cost about $2,175 a month. So it’s no surprise that home sales over the last two-plus years have been at some of the lowest levels in modern history.

Yet despite this affordability crisis, home prices haven’t declined, except in a few of the boomiest Zoomtowns of the pandemic.

In this week’s edition of DataDigest, we’re going to analyze what it would take for home sales to rocket in the fall and winter of 2024.

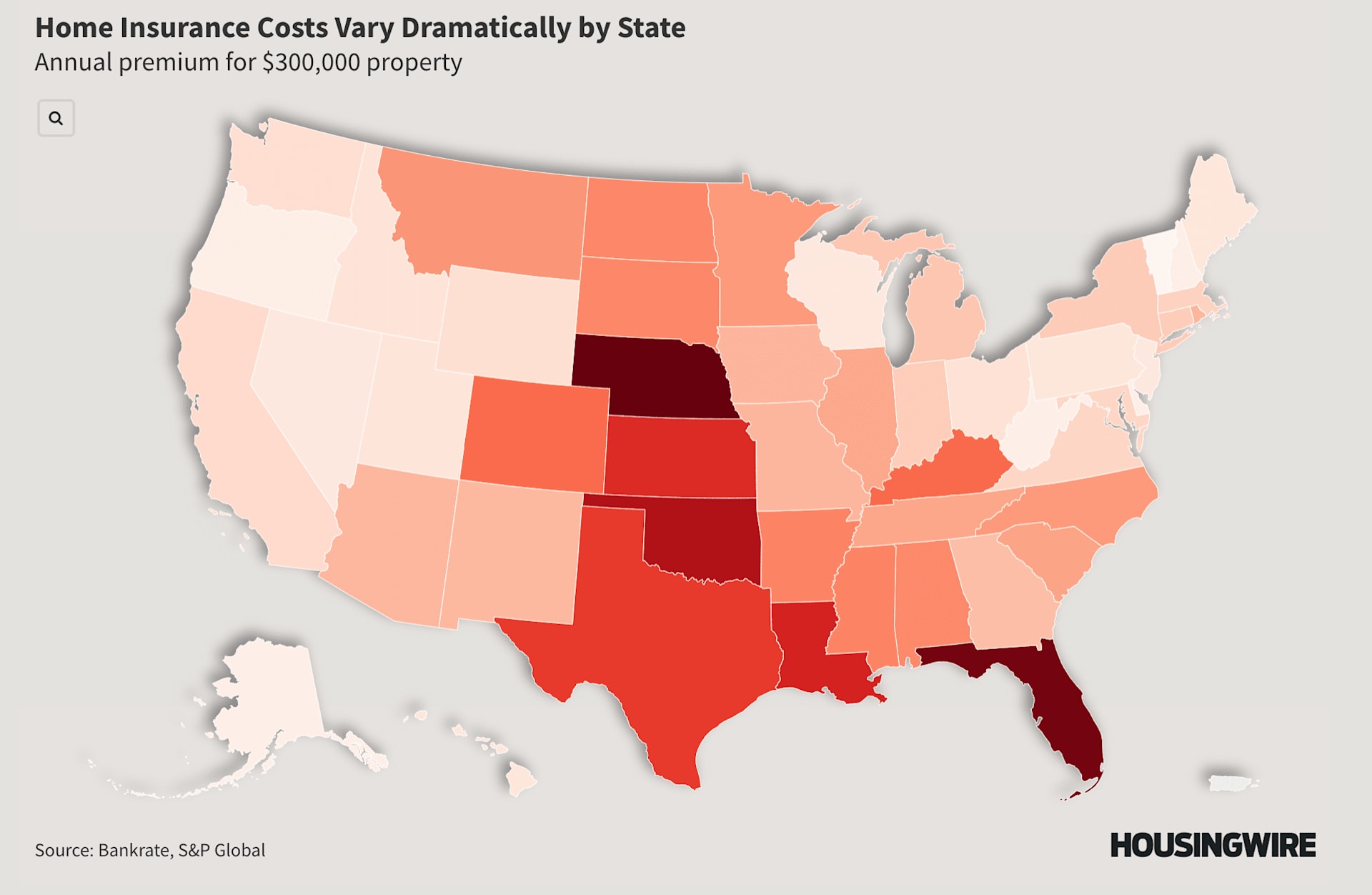

Mortgage payments are only part of the affordability challenge. Other holding costs for real estate include taxes and insurance. According to S&P Global, insurance premiums increased nationally by 34% between 2017 and 2023, with even more increases hitting homeowners in 2024.

The costs to buy a home have dramatically increased in recent years.

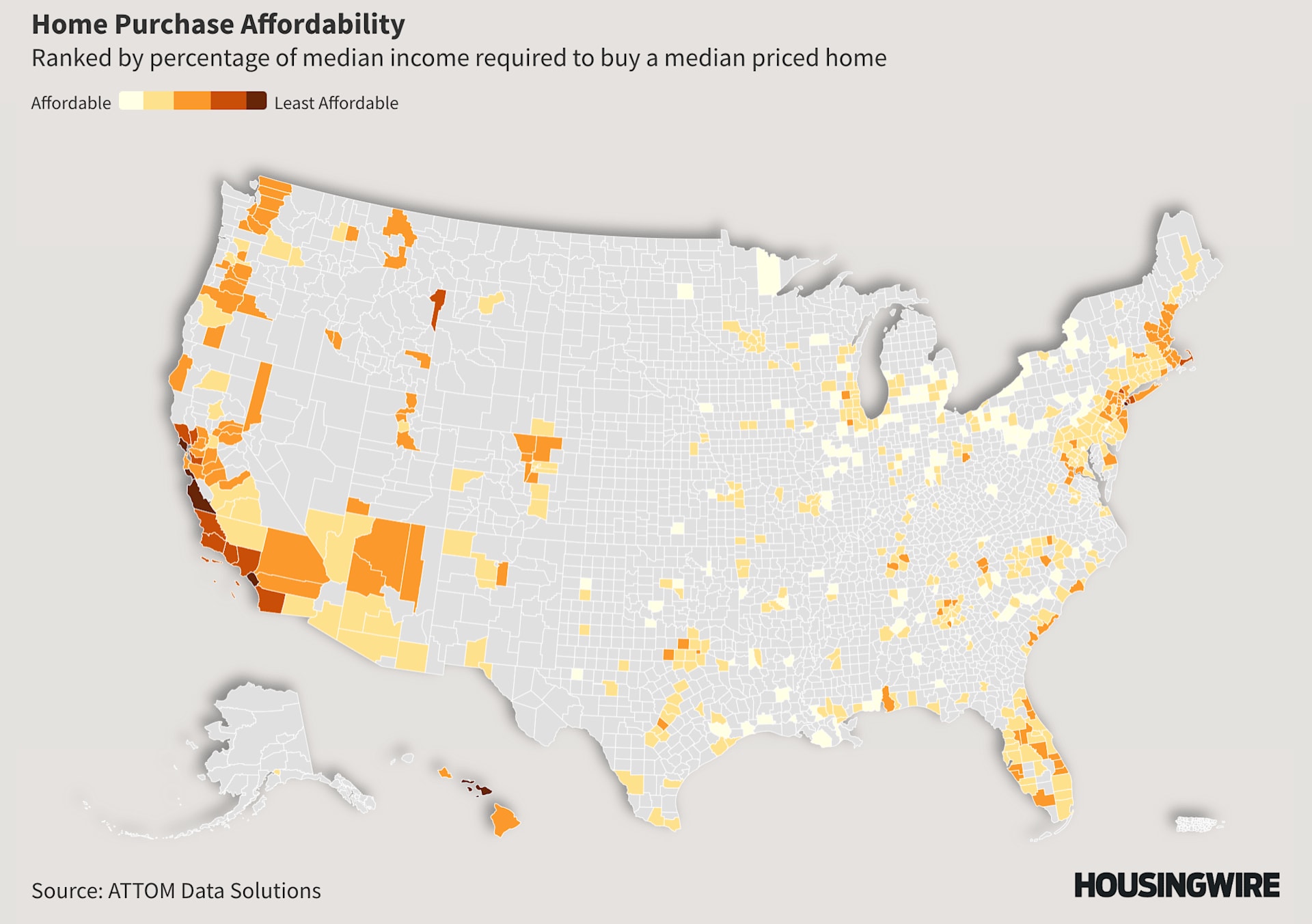

The other piece of the affordability puzzle is income. Affordability is the cost relative to a buyer’s ability to pay. As the economy grows and incomes increase, homes become more affordable over time. By the second half of 2024, with robustly growing incomes, stable home prices, and interest rates that have eased down off their peak, home buying affordability has actually been improving for months. Even still, the country faces a crisis in home-buying affordability — and homebuyers have been slow to respond.

That leads us to a couple affordability questions to tackle:

- Which areas are the most and least affordable?

- How much will demand be buoyed by improving affordability — even if mortgage rates never return to the pandemic lows?

Mortgage rates peaked in May 2024 and have slid over 100 basis points since then. As of Wednesday, many loan officers were quoting in the low 6% range for conventional conforming mortgages, and in the mid-to-high 5% range for government loan products. Each dip in mortgage rates improves affordability as payments on a home purchase decline. Mortgage payments on the typical-price home are 7% lower than last year and are 13% lower than the peak in May 2024.

If mortgage rates continue their slide along with expectations that the Federal Reserve will drop the short term interest rate at upcoming meetings, by the fourth quarter of 2024, home purchase conditions will be at their best level in two years.

In the chart below we’re calculating a typical mortgage payment for a home buyer at any given moment over the last three years. Mortgage payments are a function of the price of the home, minus the down payment, and the mortgage interest rate.

If homebuyers are lucky, mortgage rates will continue to slide into the fourth quarter 2024 and home prices will tick down with seasonal trends. Affordability will continue to improve.

Will it be enough to move the needle for homebuyers?

Home sales volumes in 2024 have remained at historic lows, with most measures of home sales pegging the rate of existing home sales at about 4 million for the year. Even as mortgage rates have fallen in the second half of the year, there is very little sign of the sales rate improving yet. It doesn’t appear that home buyers are particularly motivated by payments that are 14% cheaper now than they were in May.

This may be due to the fact that mortgage rates stayed higher — and home purchases less affordable — for longer than anyone anticipated at the start of 2024. Mortgage rates didn’t finally recede until after the prime demand part of the season. Late in the year, homebuyer demand wanes. So it may be difficult to detect any marginal demand increases until next spring.

The conventional method for ranking affordability is to compare an area’s median income to its median home price. Is a typical home affordable to a typical family in the area?

In 2020, the median priced home in Milwaukee required just 14% of the median income to buy. Today that ratio is 31%. Even though Milwaukee is among the most affordable housing markets in the country, homes there are affordable to a lot fewer people now. The demand side of a supply/demand equation is much weaker in this environment.

HousingWire used data from a recent ATTOM Data Solutions report on affordability to illustrate the most and least affordable housing counties in the country.

Homeownership affordability includes more than just mortgage payments. In particular, insurance can be a significant portion of monthly payments. As climate disasters have increased in intensity and frequency, and as replacement costs for our homes have risen as well, insurance costs are skyrocketing in many states.

Property taxes are also a significant factor for affordability for a home. Since taxes are generally a fixed percentage of the home’s value, the cost moves directly with the price of the house. Since insurance costs have been increasing relative to the cost of the home, we’re focusing here on adding insurance to the affordability ranking, but skipping the tax element.

Each state regulates its insurance markets differently. In states with fewer controls on insurance pricing, such as Oklahoma and Texas and Nebraska, homeowner insurance costs are dramatically higher than in states which tightly control insurance prices for consumers. According to data from Bankrate and S&P Global, typical insurance for a $300,000 home in Oklahoma is roughly $5,000 per year, roughly 45% more in 2023 than in 2017. Insurance for the same home in Vermont is just $806, an increase of only 6% between 2017 and 2023.

From a monthly payments perspective, while mortgage payments have added $800 to a monthly payment in Oklahoma in the last two years, insurance payments have added $200 more — a significant impact to the unaffordable premium.

When we combine the state’s average insurance costs to the local price for housing, it changes the concept of affordability a bit. Oklahoma City, which has a relatively inexpensive median price in the $240,000 range, has lower incomes and dramatically higher insurance costs than does a high home-price market such as Portland, Oregon. After accounting for insurance, affordability in these two areas starts to converge.

With these more complete costs in mind, we learn a lot more about home purchase behavior. Many of those same sunbelt markets with high insurance costs are also markets with the greatest inventory growth of unsold homes on the market in 2024.

At some point, interest rates ease back down. Over time, incomes grow. But if these insurance costs are growing faster than incomes, the high insurance states will face continued affordability challenges — even when the states that seem unaffordable because they have high-priced homes actually improve relative to their local buyer abilities.

Do unaffordable homes mean prices must fall?

It’s no surprise that the coastal California markets are the least affordable in the nation; California has been unaffordable for decades. If a market is unaffordable to most of the people who live there, why doesn’t that imply that home prices must decline? How can home prices stay unaffordable forever?

The answer lies in the market dynamics of supply and demand. If the inventory of homes available for purchase is very low, these homes don’t have to be affordable to the median income, they only need to be affordable for the richest few buyers. California has a chronic shortage of inventory compared to the population. California has 10 million more people than Texas, but has 60% fewer homes available for buyers. Restricted supply in California keeps homes chronically unaffordable.

During the last decade, American homeowners were blessed with ultra-low mortgage rates. In the post-pandemic era, very few homeowners are interested in selling. We’ve written extensively about the mortgage rate lock-in effect. As a result, many parts of the country that never previously faced inventory shortages now face California-style crises. Across the Midwest and Northeast, many cities have 75% fewer homes available for buyers than they did a decade ago.

In the coming year, if mortgage rates ease, that could indeed incentivize homebuyers who have been sidelined for two years. Watch these inventory-deprived markets, especially in the Midwest and Northeast. As buyer competition heats up, that could very likely drive home prices higher.

The affordability crisis isn’t one easily solved.

Mike Simonsen, September 11, 2024 Housingwire